Accumulated depreciation formula excel

Rs in millionAccumulated DepreciationNet BlockOn Disposalsfghef-gid-h7222432020402225013041267317749213133599372241854181156020820818541811768Depreciation. This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase.

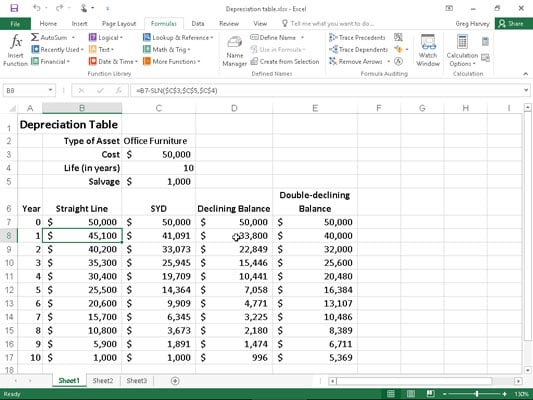

Depreciation Schedule Template For Straight Line And Declining Balance

DDB 20000400053 Click here to learn more about the DDB function.

. View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University. C45 E2-D4365 but if E2 - D4 is greater than 1825 then just write C4 value in C4 I mean. 8 Methods to Prepare Depreciation Schedule in Excel.

To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using. On December 31 2017 what is the balance of the accumulated depreciation account. For a useful life of 5 years the depreciation rate d for years 1 through 5 is 15 15 15 15 15.

Original cost x 075 to the power 2 ie OC x 075 x 075. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. D j C-S n n d C-S n SLN C Sn n In the straight-line method the depreciation amount is a constant percentage of the basis equal to d 1 n.

Depreciation Expense Total. So if you have had your asset for 6 years the net book value at the end of year 6 is. Original cost x 075 to the power 6.

During each period of an assets lifetime the straight line technique. Accumulated Depreciation Formula Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated. The total sums to 55 or 100.

DDB cost salvage life period factor The following formula calculates the double-declining balance depreciation for the 3 rd year of an asset with an initial cost of 20000 a useful life of 5 years and a salvage value of 4000. Accumulated Depreciation Calculator. Per the period for which the depreciation is being calculated.

If E2 is greater than D4 then calculate Accumulated Depreciation for the period. The equipment has a residual value of 20000 and has an expected useful life of 8 years. The accumulated depreciation is the difference between this.

Excel SYD Function Example If you have an asset that cost 1000 and has a residual value of 100 after 5 years you can. Calculate Accumulated Depreciation by Given Information Cost of the. Straight Line Depreciation Schedule.

Accumulated Depreciation Definition Formula Calculation

How To Use Depreciation Functions In Excel 2016 Dummies

How To Use The Excel Ddb Function Exceljet

Depreciation Schedule Formula And Calculator Excel Template

How To Use The Excel Amorlinc Function Exceljet

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Formula Examples With Excel Template

Using Spreadsheets For Finance How To Calculate Depreciation

How Can I Make A Depreciation Schedule In Excel

Depreciation Calculator

Depreciation Formula Examples With Excel Template

Practical Of Straight Line Depreciation In Excel 2020 Youtube

How Can I Make A Depreciation Schedule In Excel

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

How To Use The Excel Db Function Exceljet